Ryezing is a modern credit-tracking platform built to help you understand, improve, and take control of your credit with total confidence. With real-time alerts, clear insights, and a powerful credit score simulator.

As life gets more credit-driven, every swipe, payment, and new account can move your score up or down. Most credit monitoring apps only tell you what already happened. Ryezing goes further. Our real-time credit monitoring and powerful simulation engine show you how today’s choices could impact your score weeks or months from now, so you can plan moves, not react to mistakes.

of Ryezing members say credit simulations helped them make at least one smarter credit decision in their first 60 days.

more "what-if" scenarios explored with Ryezing compared to traditional monitoring alone, giving users a clearer roadmap to their goals.

is the average time members report seeing a positive score change after following a Ryezing simulation plan.

potential score range our users routinely aim for using Ryezing's goal-based simulations and guidance. (Feel free to adjust these numbers to your real data later—think of them as design placeholders.)

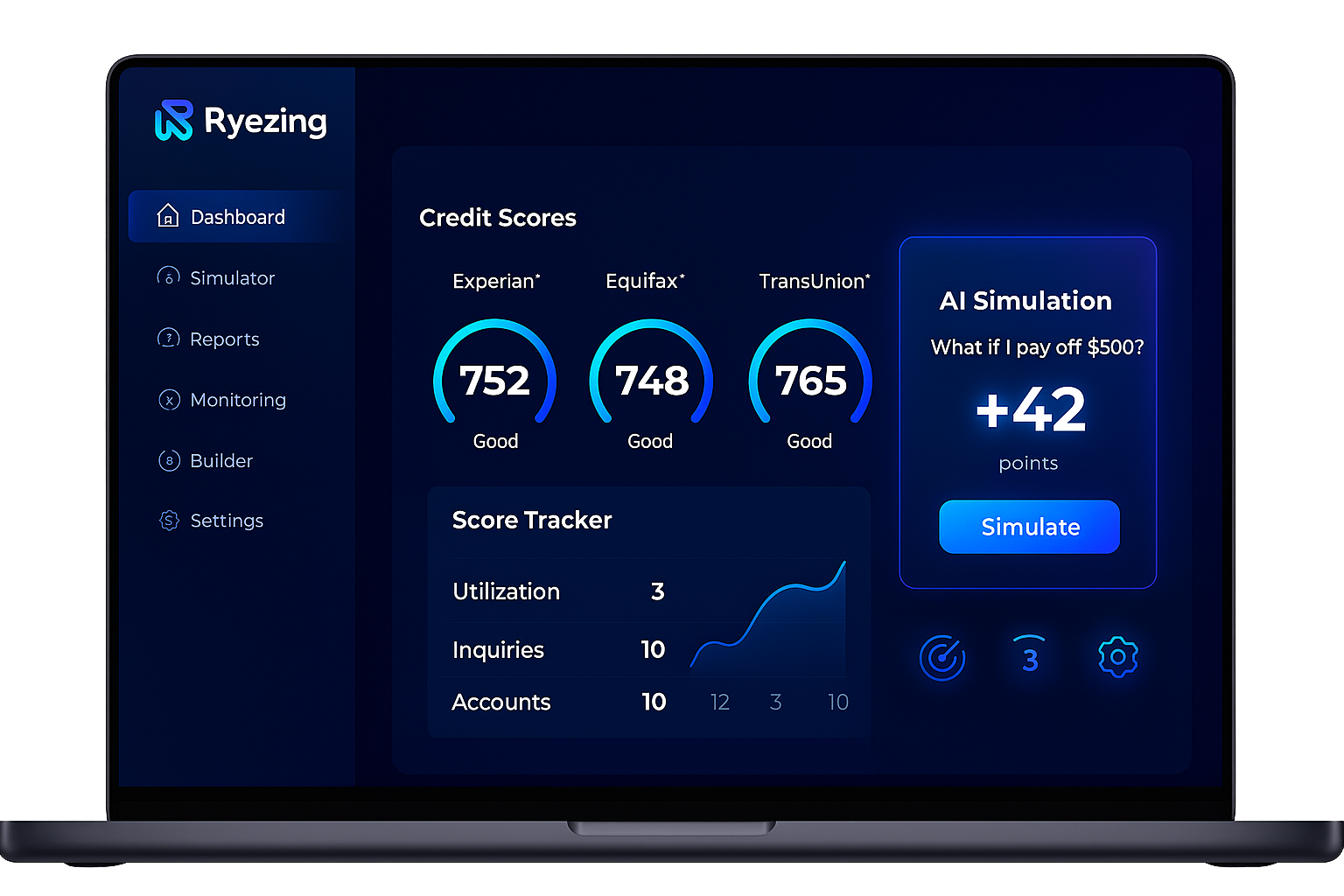

Ryezing doesn't just track your credit, it shows you where your score is headed. See how paying down a card, opening a new account, or removing a negative item could impact your score before you ever make the move.

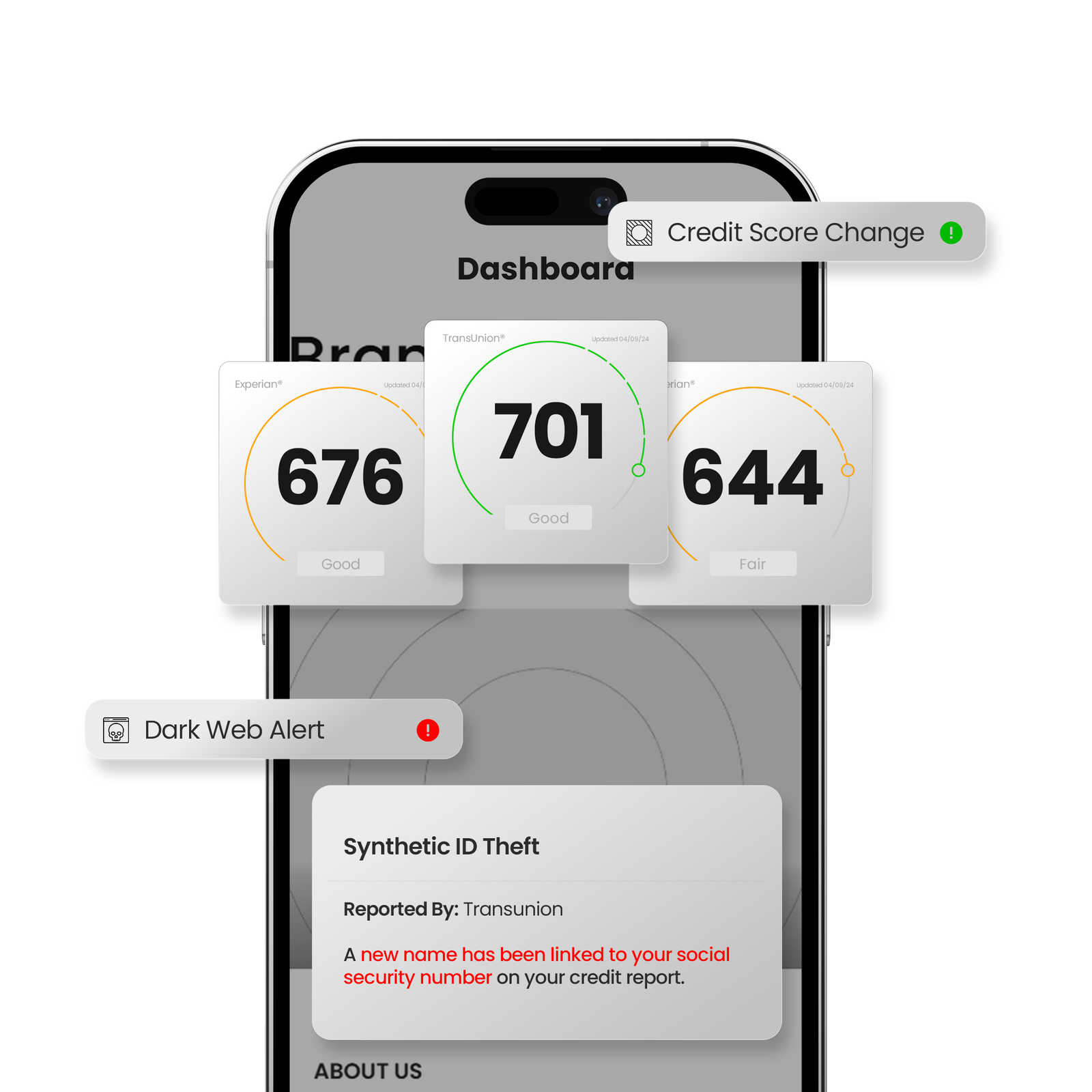

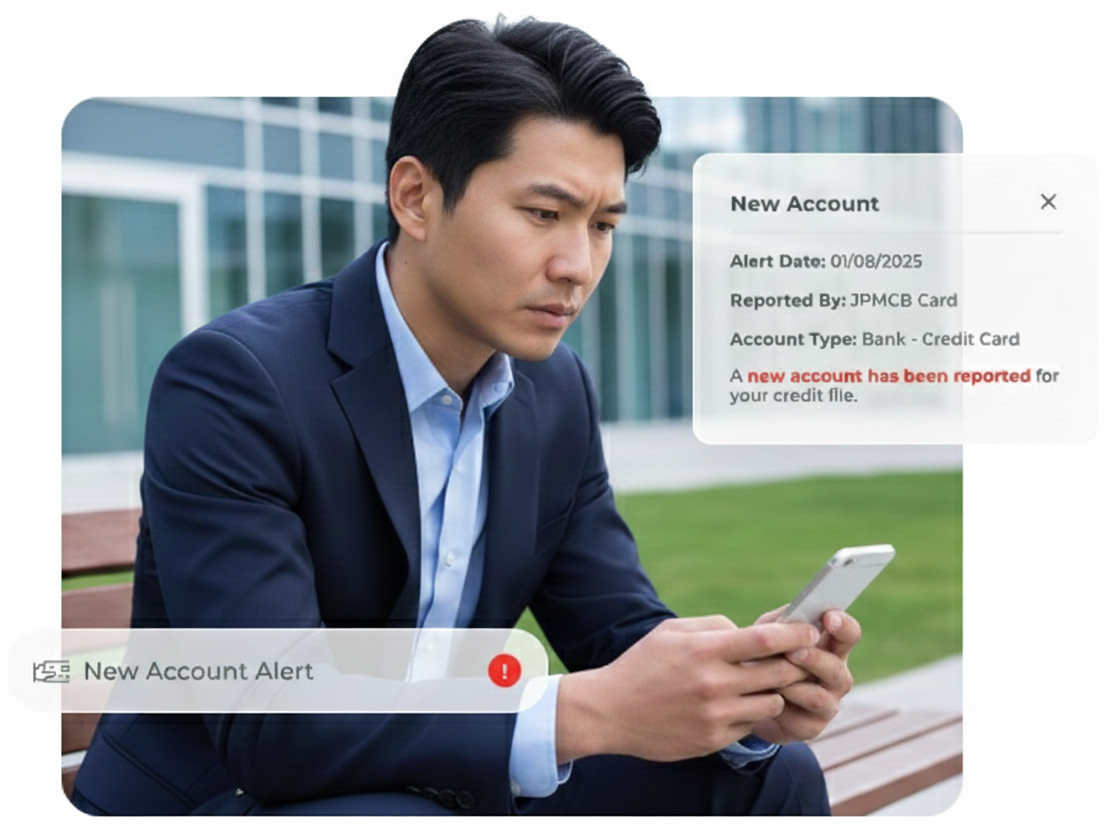

Instant notifications the moment something changes on your credit report, helping you stay ahead of unexpected shifts or suspicious activity.

If something doesn't look right, Ryezing's dedicated support team helps you identify the issue and guides you step-by- step through recovering your credit profile.

From monitoring to simulation to protection, Ryezing keeps you and your financial future fully supported.

At Ryezing, it’s not just about tools — it’s about empowering people. Our team builds credit-improving technology with intention, accuracy, and care. Because we give you clarity and prediction, you can focus on building the future you want while knowing we’re handling the complex credit data behind the scenes.

When you need guidance, you get help from a real credit specialist — not a chatbot. We’re here to walk you through alerts, score changes, and simulation strategies so you always feel confident in your next step.

Ryezing follows strict security and privacy standards to keep your credit information protected. From monitoring to score alerts to fraud detection, every step is designed to safeguard your financial identity while giving you the insights you need.

Our credit specialists and technologists understand what affects scores, what lenders look for, and how to help you make smarter financial moves. We identify risks early and give you clear steps to strengthen your credit profile.

We turn real credit behavior, lender criteria, and user feedback into tools that predict your score, guide your decisions, and help you reach your financial goals faster. Our insights power every simulation and every alert.

Only pay for what you need. Ryezing plans are built to match your lifestyle, your budget, and the level of monitoring or simulation support you want as you grow your credit.

When you need guidance, you get help from a real credit specialist — not a chatbot. We’re here to walk you through alerts, score changes, and simulation strategies so you always feel confident in your next step.

Ryezing follows strict security and privacy standards to keep your credit information protected. From monitoring to score alerts to fraud detection, every step is designed to safeguard your financial identity while giving you the insights you need.

Our credit specialists and technologists understand what affects scores, what lenders look for, and how to help you make smarter financial moves. We identify risks early and give you clear steps to strengthen your credit profile.

We turn real credit behavior, lender criteria, and user feedback into tools that predict your score, guide your decisions, and help you reach your financial goals faster. Our insights power every simulation and every alert.

Only pay for what you need. Ryezing plans are built to match your lifestyle, your budget, and the level of monitoring or simulation support you want as you grow your credit.

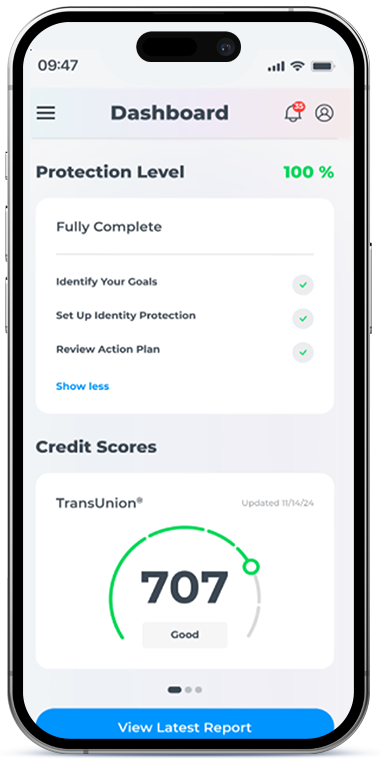

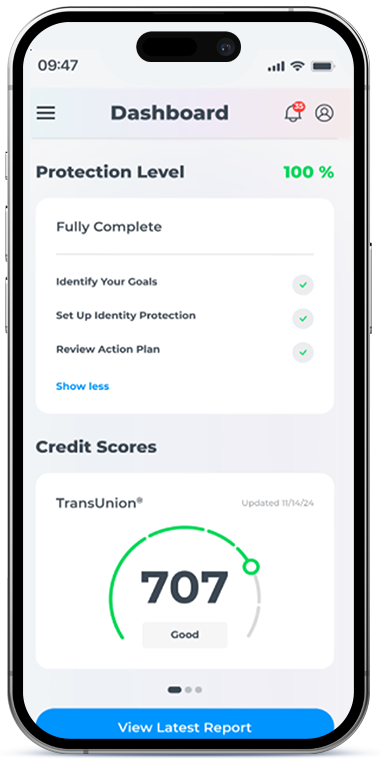

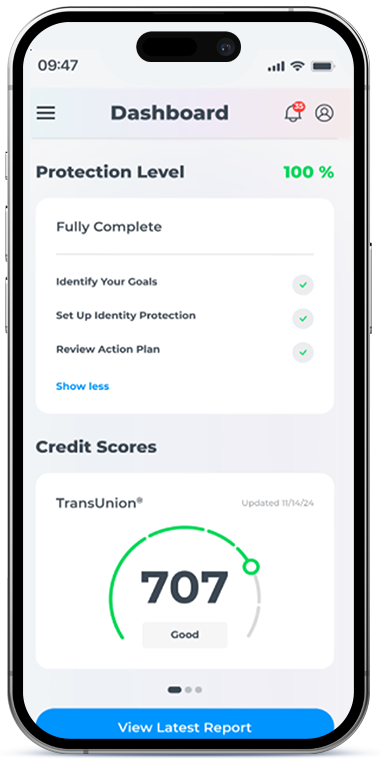

Your Ryezing dashboard gives you instant access to your credit data, simulations, alerts, and progress — everything you need to take control of your financial journey.

Monitor your credit for fraud and receive personalized actions you can take to build credit and improve finances.

See possible suspicious activity with real-time alerts, so you can take immediate action.

You have access to an award-winning U.S.-based restoration team and financial protection up to $1 million if your identity is stolen.4

Ryezing continuously monitors the most important parts of your credit profile — from score changes to new inquiries to potential fraud — all in real time. Instead of waiting for issues to appear on your report, Ryezing gives you early visibility into changes that may impact your score. With smart alerts, simulations, and predictive insights, you can act with confidence and stay two steps ahead of problems before they affect your financial future.

Ryezing delivers unparalleled Social Security number (SSN) monitoring to protect one of your most critical identifiers — and it doesn’t stop with you. With our family plan, you can also monitor your children’s SSNs, safeguarding their identities from misuse. Our advanced system scans a vast network of databases for possible suspicious activity involving your SSN or your child’s, from financial accounts to utility services. Unlike standard services that only flag mismatched names or addresses, we alert you to activity tied to these sensitive identifiers. This comprehensive, real-time protection helps make sure you and your family stay ahead of potential threats.

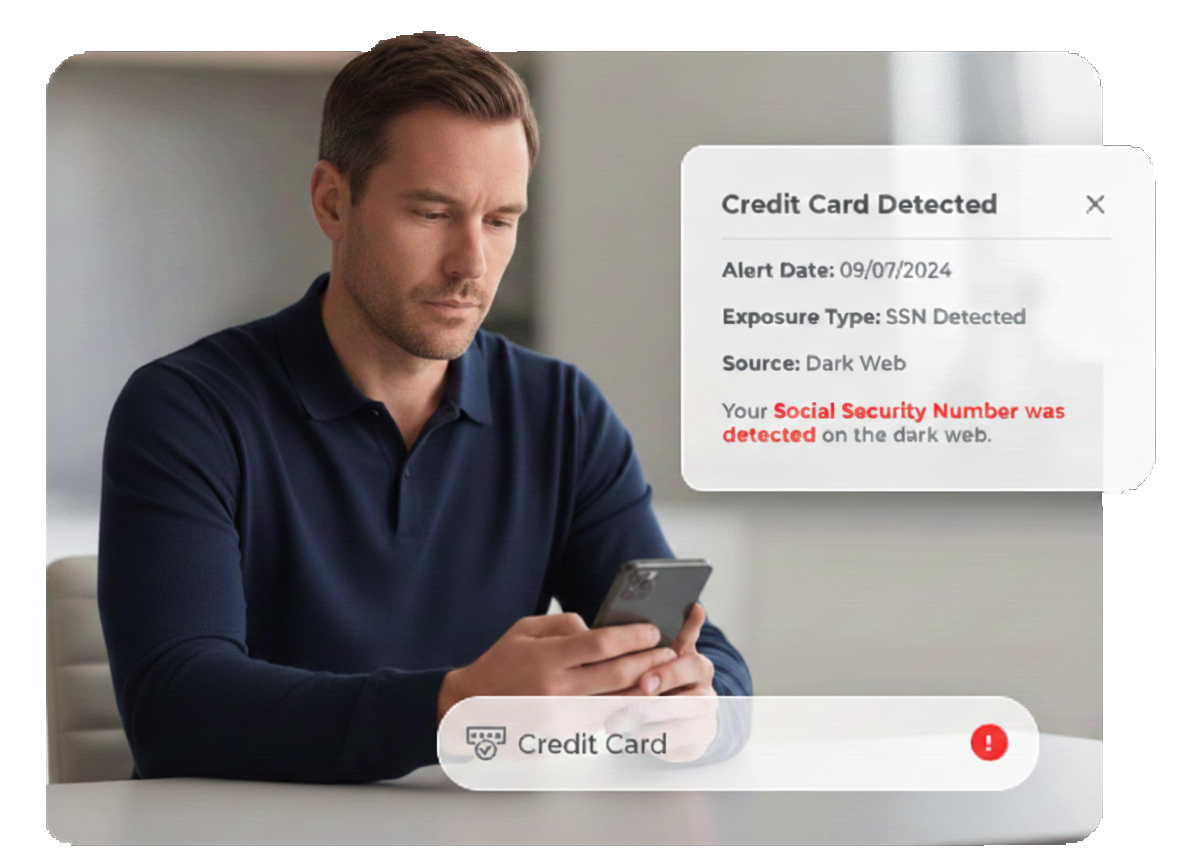

We search the darkest corners of the internet — hidden marketplaces, forums, and chat rooms — where stolen personal infornnation is bought and With the expertise of former FBI agents, law enforcement professionals, and white hat hackers, we proactively monitor for your data in real-time. Whether it’s your Social Security number, credit card details, or email address, our system continuously tracks and detects threats as they emerge. The moment your information is found, we send you an alert, giving you the chance to act immediately and prevent criminals from exploiting your stolen or leaked data.

Comprehensive monitoring goes beyond traditional credit bureaus. We track more than 180,000 data furnishers, including all three major credit bureaus, the National Change of Address registry, and the USPS system, to catch address changes and other critical data updates. Unlike standard credit bureau monitoring, which often overlooks critical address updates, our advanced system alerts you to possible suspicious activity, even if it doesn’t involve your credit.

Financial accounts monitoring goes beyond traditional bank security measures. We employ advanced AI algorithms to analyze transaction data, identifying patterns that may indicate fraudulent activity. By monitoring your accounts in real-time, we can detect anomalies such as unusual spending patterns, unauthorized charges, or transactions from unfamiliar locations. Our system can also flag potential data breaches at retailers, alerting you to potential risks before they impact your finances.

Leveraging our experience and direct relationships with major credit bureaus, Enhanced Credit Monitoring provides a comprehensive overview of your credit health. We go beyond traditional credit monitoring, alerting you to critical changes, such as the addition of authorized users, significant fluctuations in your credit score, and updates to your credit accounts. By monitoring these key indicators, we empower you to detect potential fraud or unauthorized activity early on, safeguarding your financial future.

Your credit score determines your financial opportunities — but traditional monitoring only tells you what already happened. Ryezing goes further. Our platform analyzes your data, reveals the “why” behind your score, and helps you forecast what’s coming next.

Users who want foundational credit monitoring and clear insight into what’s driving their score.

Users who want monitoring and proactive control over their financial identity.

Users who want full credit monitoring, identity protection, and powerful simulation to predict and improve future scores.

Run powerful credit simulations, monitor real-time changes, and spot fraud before it hurts your score—all in one simple dashboard.